Getting Your Net Number; It’s About Planning.

As a business owner myself and a former member of Vistage, the topic of selling was always present. Our chairperson was forever coaching us about our “number”. “What’s your net number?” “What do you need to do the next thing?” Much has been written about timing the sale of a family business or the purchase of one for that matter, but it seems less has been written or effectively communicated about the process of maximizing your business’ value to ensure you can tackle your “next thing” without anxiety. Getting to that “net number” is important. All too often we witness the decision being made around some trigger and not from the long view’s vantage point. That’s problematic on a number of levels, but let me just share a few to get you thinking.

This won’t win me a popularity contest, but almost universally owners think the value of their business is greater by a wide margin than it actually is. The problem is compounded when they do a “back of the napkin” calculation of the net proceeds (“x” times EBITDA less 25% for taxes and selling related expenses = walking away from cash). The actual net is most often far less than that simplistic approach (it’s complicated) and rarely sufficient to deliver the lifestyle owners are dreaming of. You just can’t maximize your company’s value when planning the exit begins six months from the planned event!

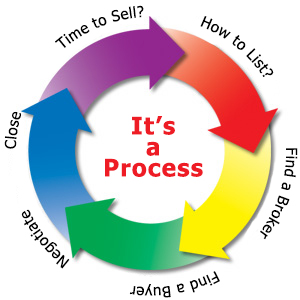

Now I know you’re saying you’d never do that and yet, we see it all the time. Without a proper team and sufficient time, the hard questions are never asked or sufficiently answered. The gap between valuation expectations and real-world values just doesn’t get closed. This sets up a very real and costly phenomenon. Did you know that 85% of businesses listed for sale fail to sell? Of the 15% that do, the planning process begins at least three years out. For businesses valued at less than $2,000,000, the percentage successfully closing goes down to only 10%. So, why is that? Some would say unscrupulous brokers take the over-priced listing knowing it can’t sell to collect the retainer. When the predictable happens and interesting offers are consistently lower than the price, reality sets in but only after precious time has been lost. The realities of choice settle in. Either take the lower price or stop, regroup, and plan for another day. Our observations are that many businesses don’t hold up to the scrutiny of the due diligence process resulting in unacceptable lowball offers. That’s a condition that can be remedied with planning and time. It is very straight-forward.

The remedy, or at least one remedy, is to insist on assembling the right team. Your lawyer or accountant are great referral sources as might be your banker. If they insist on doing it themselves, however,…walk. Their roles are important but generally not well suited for quarterbacking the process. Consider that every NFL quarterback, players at the top of their sports, have coaches. Then consider that the final two quarterbacks who make it to the Super Bowl each continue to rely on those coaches. The right coach is just like a legitimate consideration for CEO’s playing in the most important game of their lives. Someone like William Anton, Ph.D. of CEO Effectiveness, who has successfully guided CEO’s through the maze of tough questions for years, to ensure they get to the important answers behind the tough questions (Why are you selling? When should you sell? How should you manage the process? To whom should you sell?...). As I said, it’s complicated.

Another tough set of questions, rarely asked, centers on the very real topic of long-term healthcare and caregiving. According to AARP Beyond 50, 2003: A Report to the Nation on Independent Living and Disability, 2003 as stated by the Family Caregiver Alliance, “The lifetime probability of becoming disabled in at least two activities of daily living or of being cognitively impaired is 68% for people age 65 and older.” This is not only a sobering thought but a very real and probable expense that is often neglected in planning that would inform the answer to the question, “What’s My Net Number”?

So take a step back and consider the value of a team approach to gain an advantaged position in selling your family business. Give yourself and your family the benefit of a longer, rather than shorter, planning horizon.